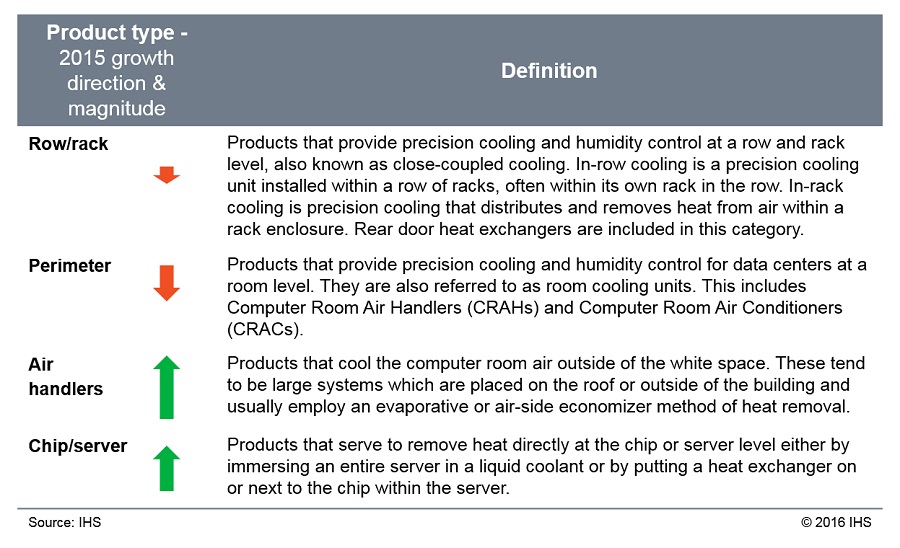

The data center cooling market declined slightly in 2015 by 0.4% but is projected to grow by 1.0% year-over-year in 2016 according to IHS Markit. While the market as a whole is close to flat, this is the net result of some very differing growth rates among the various product types driven by the shifts occurring within the data center cooling market.

Markets that declined in 2015:

Revenue from both the row/rack and perimeter cooling product categories declined slightly in 2015. Of all the cooling product types, these are the ones most negatively affected by the trend of data center consolidation and the increased use of cloud and colocation services, although this is just one of many factors. Consolidation negatively affects the cooling market in a couple of ways:

- Colocation, cloud, and large centralized data centers tend to have more optimized cooling designs that minimize operational costs, maximize efficiency, and reduce the physical amount of power and cooling equipment needed.

- Because colocation and cloud companies are absorbing parts of what was once the enterprise data center market, they account for an increasing share of the total data center market and now hold a lot of negotiating power when purchasing data center infrastructure. They can often negotiate lower pricing on things like cooling equipment, negatively affecting revenue.

Consolidation of data center operations, whether inside or outside cloud and colocation facilities, is effecting mature data center markets more so than developing data center markets. IHS predicts that row/rack and perimeter product categories will return to growth within the next couple of years due to increasing rack density and adoption from rapidly-growing developing data center regions, respectively.

Markets that grew in 2015:

Comparatively, the large air handler and chip/server-level cooling equipment (both immersion and direct-to-chip varieties) are growing at higher rates, though they still account for a smaller portion of market revenue, than the more traditional row/rack and perimeter cooling equipment. In 2015 and 2016, IHS estimated and predicts high single digit growth rates for these products, but by 2017 and beyond, both segments are projected to grow at double digit rates year-over-year.

The high growth in the chip/server-level cooing equipment is mainly due to the fact that this is still a very small market, so any growth is a large leap percentage-wise. In 2015, chip/server-level cooling products still only made up less than 1% of the revenue from data center cooling equipment. The increasing growth rates over the next five years will be driven by:

- Advances in chip technology that will lead to very high power chips and servers that have much higher processing power, which will likely require liquid cooling.

- Increased use of GPU clusters and high speed, high density processing.

Growth in the air handler market has been substantial over the last couple of years and is almost exclusively driven by new build outs of large data centers. As colocation and cloud companies continue to build new facilities and expand to new regions, the air handler market is predicted to grow accordingly.

In 2015, the factors affecting each data center cooling product type resulted in a slightly negative performance overall. However with very different trends occurring in each category, IHS believes the carefully counter-balanced drivers and inhibitors affecting each will result in growth in the coming years.